Social Security

Social Security payments are defined as Class 1 for employees and Class 2 for the self employed.

Employers must submit quarterly returns for employees by 15th of the month following quarter end and make payment on receipt of an invoice from the Social Security Department.

Class 2 contributions for the self employed are payable quarterly on receipt of an invoice from the Social Security Department for the calendar quarter end.

Class 2 contributions are calculated based on individuals earnings from 2 years previously.

Employers must pay a 6.5% rate on their employees’ earnings up to SEL, and 2.5% between the SEL and UEL in 2025.

Contribution levels from

1 January 2025

Table showing percentage of wage that must be contributed per month up to the Standard Earnings Limit of £5,800.

| Who must pay | Percentage of wage to be contributed |

|---|---|

| Employee | 6.0% January to December 2025 |

| Employer | 6.5% up to the SEL |

| Employer | 2.5% between the SEL and UEL |

Table showing the Monthly Earnings Limits and maximum Class 2 contribution rate per month.

| Monthly Earnings Limit | Amount per month |

|---|---|

| Upper Earnings Monthly Limit (UEL) | £26,442 |

| Standard Earnings Monthly Limit (SEL) | £5,800 |

| Lower Earnings Monthly Limit (LEL) | £1,240 |

| Maximum rate Class 2 contribution | £1,241.05 |

| Standard Rate | £725.00 |

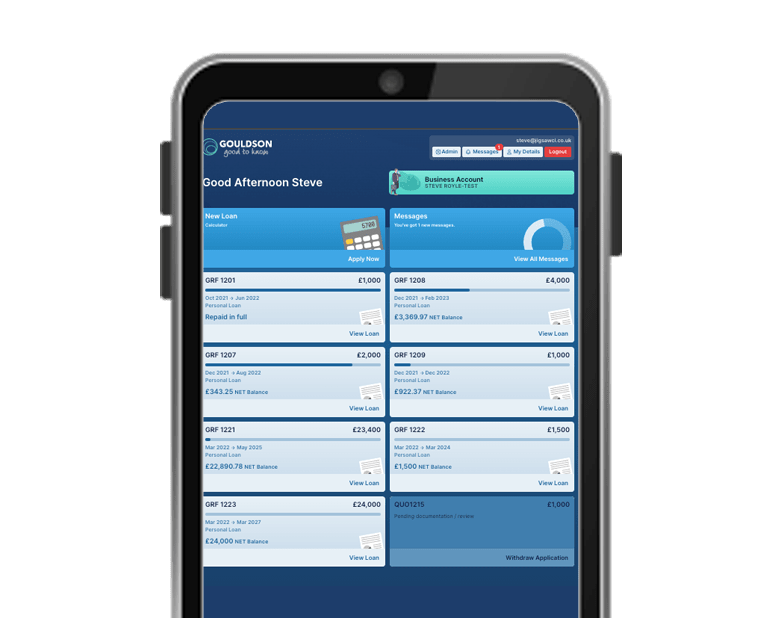

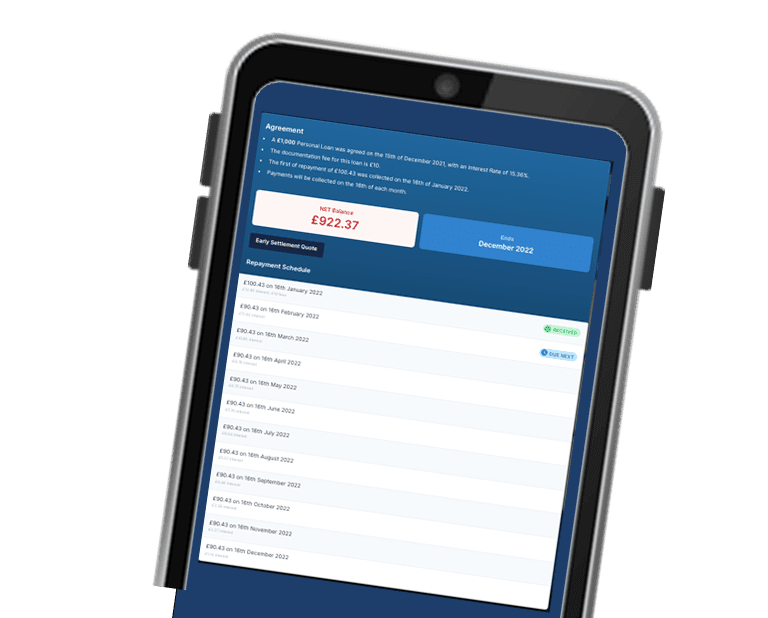

Take a break from running your business

With Gouldson, we can help with all the accounting, finance and payroll tasks.

Go for the healthy option and share the workload with us.

Now that's good to know.