Secured Loans

A secured loan is one which uses an asset as security for the lender in case you fail to repay the debt.

This is your home typically, or another asset that’s worth more than the loan amount.

It works just the same as a personal loan, except for the fact that if you default on your payments, you’re at risk of losing whatever is being used as security.

As the lender has security, you may be offered lower interest rates and longer terms than if you took out an unsecured loan. You must consider carefully if this type of loan is right for you if you have low or bad credit score. There will be a risk of losing your house if you cannot make the repayments in time.

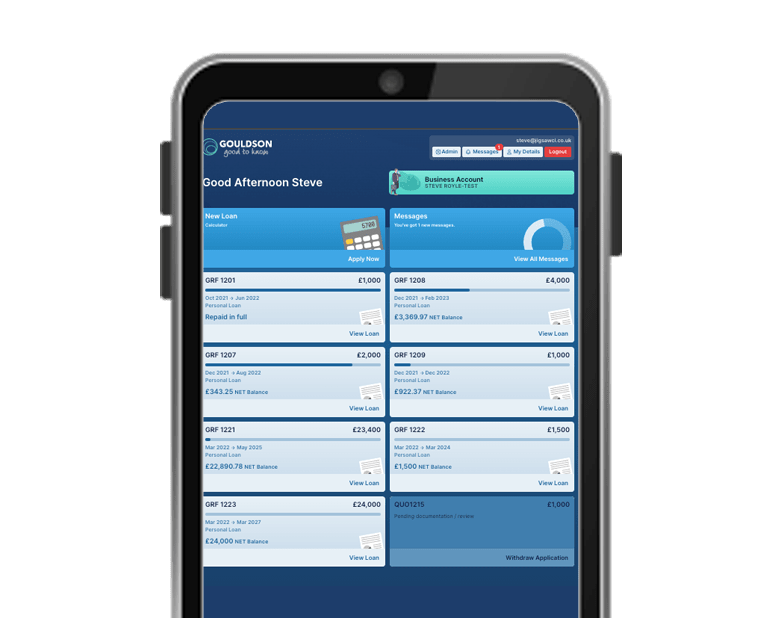

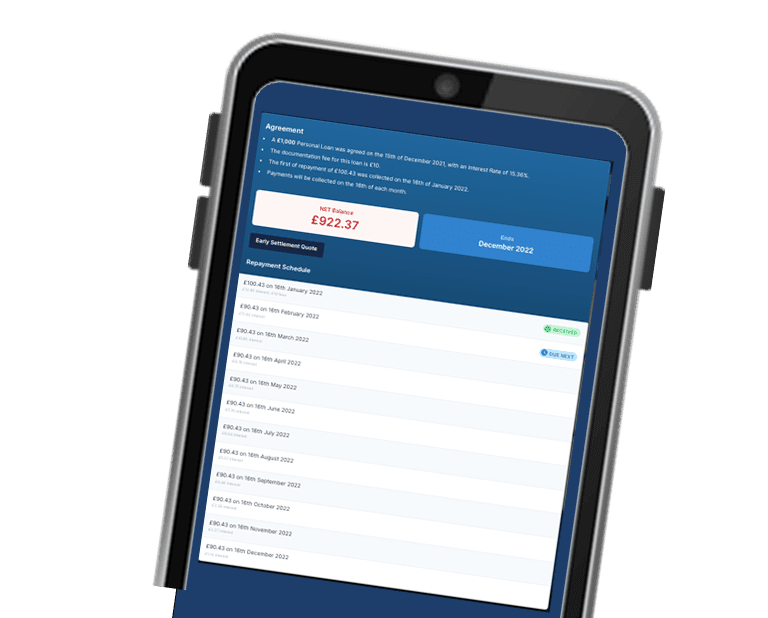

Why not contact one of the team at Gouldson today to see how much a loan from Gouldson would cost. Apply on line or call us for a chat on 01534 840148.

Apply for Finance

Start a Conversation Today

Making time for incredible work.

At Gouldson we are proud to provide our clients with quality, affordable and professional work.

Accountancy | Finance | Tax